Where’s the Recession?

“Uncertainty always creates doubt, and doubt creates fear.” – Oscar Munoz

For nearly two years now, economists, politicians, and news reporters have been predicting an epic recession. Or a mild recession. Or a short one, or long one. At the beginning of 2022, we had two consecutive quarters of negative gross domestic product. But no one called it the “r” word because all other indicators didn’t materialize as they should in an economic downturn. We talked about this in a previous blog entitled ERP Recruiting and Hiring Trends to Start 2023. Wages steadily increased, unemployment went down, inflation increased, but spending also increased. Economists were left scratching their heads. Many industries began to tread cautiously, especially in big spending areas like proactive hiring and ERP software investment. Many companies chose to focus on enhancing their current software rather than new technologies. So Acumatica, Sage, NetSuite, Microsoft D365, and Odoo partners hesitated increasing their ERP staff because end users weren’t buying new technology. This fear of the unknown has left many industries nervous about jumping back in the pool. But as more are dipping their toes in the water, even more are asking “Where’s the Recession?”

The Numbers

Once again, all the experts have conflicting predictions, despite the numbers. “It seems likely the economy may avoid a recession,” according to Matt Schoeppner, senior economist at U.S. Bank. “The chances of a soft landing are higher,” comments Diane Swonk, chief economist at KPMG US. A recent article in Reuters reports that the Conference Board is sticking to the “forecast that the U.S. economy is likely to be in recession from the current third quarter to the first quarter of 2024.” And Robert Fry, founder of Robert Fry Economics rated the chance of a recession at 90%.

But the numbers themselves are all good:

- Experts were predicting a slower Q2 than Q1 economy. Q1 saw a 2% GDP. Q2 was at 2.4%. That’s four quarters in a row of an expanded economy.

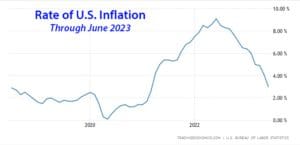

- Inflation has been going down for 12 straight months and stands at 2.97%. Last month it was 4.05% and last year it was 9.06%. It’s even lower than the long term average of 3.28%

- Wages are outpacing inflation for the first time since the initial post-covid “surge”.

- 209K jobs were added in June. Unemployment is at 3.6%. It’s been under 4% for 17 consecutive months, the longest stretch in over 50 years.

So why are they still concerned about a recession? A big reason Fry is still giving a 90% chance of a recession is because of an indicator called the yield curve. It tracks the difference in yields between long-term and short-term bonds. Right now, short-term bonds have a higher yield than long-term bonds, a traditionally reliable recession indicator.

Basic Economics

It really comes down to the basic law of supply and demand. As unemployment continued to plummet and wages began to increase, right on the heels of a nearly stalled economy due to the pandemic, manufacturers and producers of goods and services couldn’t keep up with the demand. To help beef up production (and to take advantage of the situation in some cases), prices of goods and services were inflated. As the demand for goods and services increases, jobs have been created leading us to a historic low of 3.6%. However, when unemployment is that low, there are not enough workers for all the jobs being offered. So, to lure employees away from their current jobs, wages increase. And if you’ve recently been on the hunt for an Acumatica Implementation Consultant or Sage Sales Executive or Dynamics Business Central Project Manager, you’ve probably felt that pain.

But, those wages haven’t been increasing as quickly as inflation. So people are spending more, but getting less. That’s where the Federal Government steps in. They increase the interest rates which makes it more expensive to borrow money and makes the cost of goods and services even more expensive. That way, people will spend less which will, in theory, drive down the cost of goods and services once they are more readily available.

But Why?

When times are good for workers (low unemployment, increased wages, increased spending, getting more for what you pay for), apparently it’s bad for the economy. Suppliers can’t keep up with demand, so they inflate prices which the government compensates for by . . . raising prices. But, to avoid a recession, workers must keep spending money, even though they’re getting less for it. So the workers are punished when times are bad, and when times are good. Meanwhile, big corporate CEOs are making record profits.

As political comedian Jon Stewart reported on a recent episode of “The Problem”, the solution to the pain of inflation is . . . well, more pain. Wages need to decrease, unemployment needs to rise, people need to get laid off. While employee wages have never kept pace with cost of living increases, the compensation for CEOs as a ratio of their workers has increased exponentially.

So What Do You Do?

No one has a crystal ball. If there was such a thing, I guarantee there wouldn’t be such a wage gap between CEOs and workers. But what does all this mean for the ERP business? Like the internet, cell phones, movie and TV streaming, and other technologies, ERPs are here to stay. If you don’t want to get left behind like Blockbuster, you need to look at all the ways your company can benefit from implementing one. They offer better and more consistent analysis, they increase productivity, they enhance customer satisfaction, they decrease mistakes and oversights, and they save money.

And, whether you’re a VAR that sells and implements ERP or a company that just bought one, you’re going to need ERP experts to handle sales, demos, implementations, administration, and analysis. Getting ahead of the game and having those positions in play and trained is hard now in this economy. With record low unemployment, you need experts in recruiting to help you find the qualified talent that isn’t actively looking for work. And that’s where companies like DyNexus come in. Like an ERP, working with the right recruiter can save you time and money. So perhaps the more important question right now is “How can DyNexus help?” rather than “Where’s the Recession?” At least the first one actually has an answer.